Bauen Sie mit uns einzigartige Banking-Produkte

Unsere Banking-as-a-Service-Plattform hat alles was Sie brauchen, um Ihre eigenen Banking-Produkte zu bauen.

Trendsetter aus allen Branchen vertrauen auf uns

Europas größte Embedded-Finance-Plattform

Solaris ist ein Technologieunternehmen mit einer deutschen Banklizenz. Mit weiteren Lizenzen für E-Geld und Wertpapierhandel können wir europaweit im Finanzwesen tätig sein.

Mit unseren schlanken APIs können Sie unsere digitalen Banking-Services direkt in Ihr Produkt integrieren. Wir bringen das Beste aus den Welten Technologie und Banking zusammen und kümmern uns um alle regulatorischen Aspekte, damit Sie sich auf das konzentrieren können, was wirklich zählt: Ihre Kunden.

Über unsUnsere Lösungen für Ihre Embedded Finance-Ideen

Digital Banking

Bauen Sie Ihre eigene Neo-Bank auf und bieten Sie verschiedene Arten von Konten mit unseren APIs für digitales Banking und Konten an.

Payments

Optimieren Sie Ihre Zahlungsdienste mit unseren Markenkarten, Buffer für Karten und Zahlungsflüssen.

Kredite

Offer consumer and SME loans to your customers in your own branding. Paperless, fast and mobile.

Identifikation

Onboard your retail and business customers smoothly and securely with our digital KYC services.

Banking-Technologie am Puls der Zeit

Führende Technologie

Unsere einzigartige Banking-as-a-Service-Plattform verfügt über einige der modernsten RESTful-APIs auf dem europäischen Markt. Unsere APIs sind für Skalierbarkeit und internationale Expansion ausgelegt.

Cloudbasiertes Banking

Unsere gesamte Banking-Infrastruktur ist cloudbasiert. Auf diese Weise erschaffen wir besondere Bankdienstleistungen für die Kunden unserer Partner. Wir sind führend in der Entwicklung innovativer, digitaler Finanzprodukte.

Leistungsstarke APIs

Mit unseren eleganten, via API zugänglichen Services können Sie die Daten Ihrer Kunden während der gesamten Nutzungsdauer in Echtzeit verwalten: vom ersten Kontakt bis zum langfristigen Support.

Daten-Mesh-Architektur

Nutzen Sie unsere hochmoderne Data-Mesh-Architektur, um wichtige Daten für die Entscheidungsfindung, Planung, Prognose und Einhaltung gesetzlicher Vorschriften zu nutzen.

Warum Sie mit uns zusammenarbeiten sollten

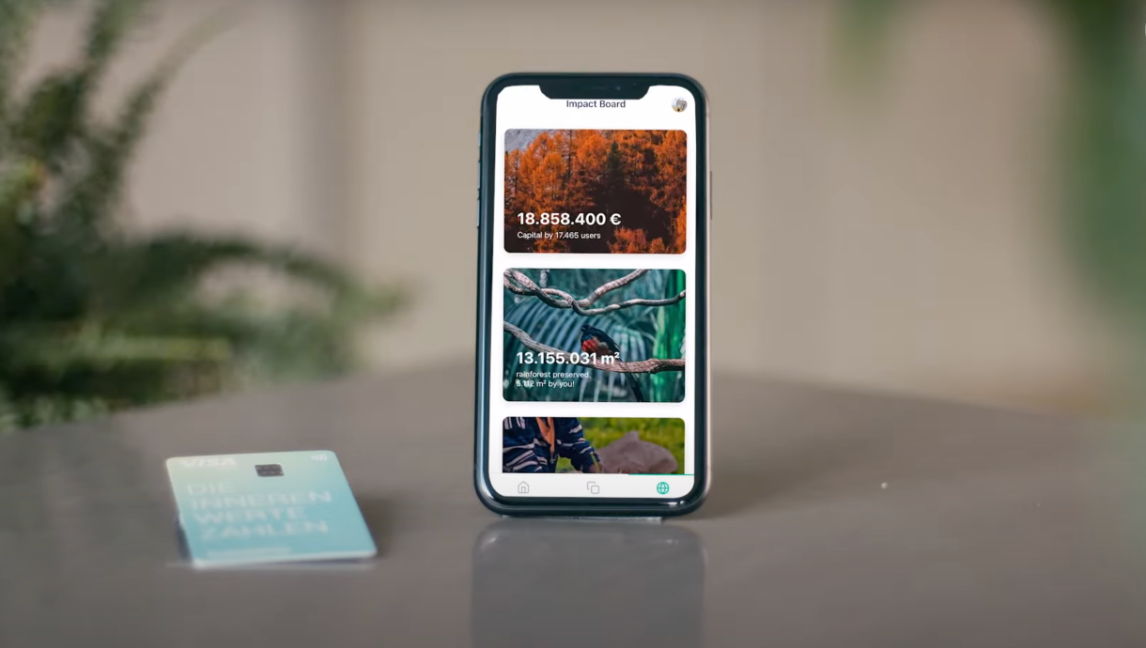

Neutralität

Als B2B2X-Plattform ist Solaris immer ein neutraler Partner und steht nie im Wettbewerb um Kunden. Alle Produkte werden stets an das Markendesign unserer Partner angepasst.

Schnell und nachhaltig

Unsere Plattform garantiert eine zügige und einfache Produktanpassung für erstklassige, kundenorientierte Finanzdienstleistungen – inklusive schneller Marktreife.

Stärkere Kundenbindung

Integrieren Sie Finanzdienstleistungen in Ihre Produktlandschaft und erhöhen Sie mit diesen Services die Kundenbindung. Maßgeschneiderte Finanz-Features sind das perfekte Add-on, um als Marke in Erinnerung zu bleiben.

Deutsche Vollbanklizenz

Mit unserer deutschen Vollbanklizenz und weiteren EMI Lizenzen können wir in allen EU-Ländern und UK tätig sein. Wir kümmern uns stets um alle aufsichtsrechtlichen Pflichten, damit Sie sich auf die Entwicklung des besten Produkts für Ihre Kunden konzentrieren können.