Case Studies

In the Spotlight:

Banking-as-a-Service

Cards

Big Tech

Fintech

Startup

BNPL - Splitpay

Digital Banking

Big Tech

Corporate

Accounts

Digital Banking

Bank

Fintech

Startup

Cards

Digital Banking

Bank

Fintech

Cards

Big Tech

Startup

Cards

KYC Platform

Big Tech

Startup

Bankident

BNPL - Splitpay

Cards

Big Tech

Corporate

Cards

Digital Banking

Bank

Fintech

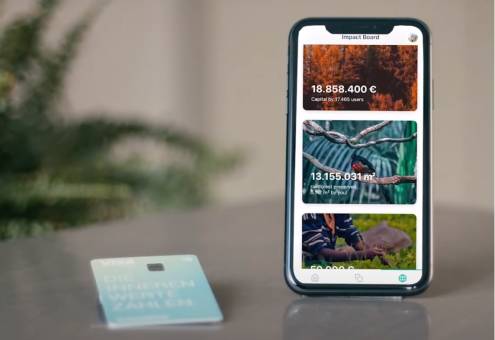

Cards

Digital Banking

Fintech